How the surge in house prices could affect securing a mortgage

07/10/20

House prices have reached a record high following the introduction of the Stamp Duty holiday and viewings now being allowed after a temporary ban due to Covid-19.

The Halifax House Price Index reports house prices have increased by 5.2% year-on-year; the strongest growth since 2016. Despite current economic uncertainties, the average house price is now more than £245,000. This is the highest ever average recorded by Halifax.

This rapid increase in price could affect the cost of your mortgage. Whether you’re a first-time buyer looking for a home, planning a house move to accommodate the changing needs of your family, or looking to remortgage your property, read on to find out how you could be affected.

Will house prices continue to rise?

The spike in house prices has partly been driven by an increase in market activity. According to This Is Money, demand for houses is up by a third from this time last year.

A backlog of buyers who couldn’t complete their purchases during lockdown all entered the market at once when house viewings were allowed again. Some people moved their plans to buy a house forward by several months, enticed by potential savings from the Stamp Duty holiday.

However, once these people have completed their sales the demand for houses, and therefore their price, could decrease.

The end of the furlough scheme on 31st October, which will be replaced by the Job Support Scheme, could also affect demand. According to The Telegraph, unemployment could rise by 7.2%. This could further reduce the number of people in the market for a house. As the demand for houses goes down, you should see a decrease in prices as well.

You could have higher monthly mortgage payments

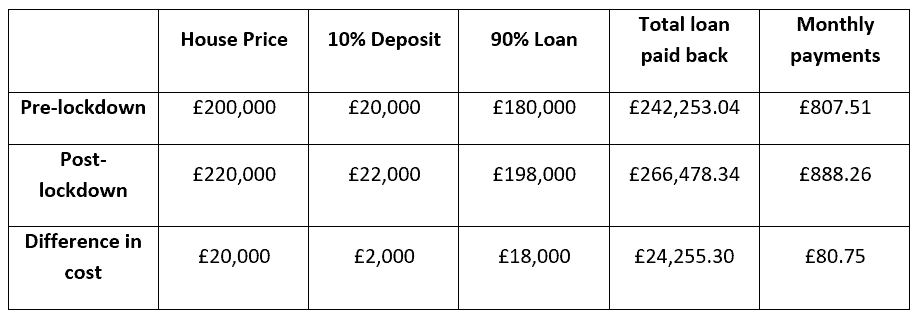

If you’re looking for a mortgage now, rising house prices mean that you’ll have to pay a higher deposit, borrow more, and pay back more overall compared to a house bought before lockdown.

For example, let’s look at a home which may have cost you £200,000 earlier in 2020 but costs £220,000 now. Consider the additional costs on a house bought now, on a capital and interest mortgage paid back over 25 years at a 2.5% interest rate:

Source: Which?

First-time buyers may struggle

If you’re looking for your first home, you may find it more difficult to get a mortgage right now for several reasons.

Firstly, you might struggle to secure a mortgage if you’ve been furloughed. The Financial Times reports that several banks are no longer accepting mortgage applications from people on furlough, or will not take income from furlough pay into account when conducting affordability assessments.

Additionally, there are fewer low-deposit mortgage deals available. According to The Guardian, nine out of ten 5% and 10% deposit mortgages have been withdrawn by lenders amid economic concerns and a rising risk of negative equity.

As house prices rise, it also follows that you’re likely to need a larger deposit. As shown in the example above, a 10% deposit on a home valued at £220,000 is £2,000 higher than the same property valued at £200,000.

Because of the reasons above, The Guardian reports that the average deposit buyers have to put down has grown from £22,000 to £33,000 since lockdown.

The Guardian also reports that fixed rates on the deals that remain have increased. For example, the average rate on a two-year fixed mortgage at 90% LTV rose from 2.57% in March to 3.54% in September. This means that your monthly payments may be higher too.

Even if you manage to secure a mortgage, you’re still at risk of negative equity. With many experts predicting that house prices could fall in 2021 as the economic situation worsens, you could be left owing more than the value of your home if you take out a low-deposit mortgage.

Existing homeowners could benefit

If you’re an existing homeowner, you could be in a better position than first-time buyers. Although you may make more money than expected on the sale of your house, you’ll need to keep in mind that the new property you want to buy has most likely increased in value as well.

However, the rise in prices could benefit you if you’re thinking about remortgaging your property. Your home may be worth more right now but, as you still owe the same amount, the equity you have may have risen.

This could help you to access lower interest rates. Keep in mind that your personal situation and lending criteria may have changed since you last applied for a mortgage, so securing a mortgage with a better interest rate is not guaranteed.

Get in touch

Although the market is challenging right now, we can help you navigate it. Contact us now for support on your mortgage.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage.